A synergy with many assets for the future

Introduction : Energy as the engine of civilization

Let us explore how human evolution and the development of civilization have been made possible by a growing mastery of energy. From the first fires to modern power plants, every stage of harnessing new energy sources has enabled human societies to progress, improve living conditions, and push the boundaries of what is possible.

Evolution of Civilization Through Mastery of Energy

Early Energy Discoveries: Fire

The discovery of fire marks one of the first major energy revolutions in human history. Fire allowed humans to cook food, which improved nutrition and health. Beyond food preparation, fire provided warmth for homes, protection against the cold, and enabled the colonization of more hostile regions. This initial mastery of energy had a direct impact on survival, health, and the geographical expansion of humanity.

Harnessing Animal and Natural Energy

The use of animals for agricultural work represented a significant step, as it increased productivity and spared humans from physically exhausting tasks. Horses, oxen, and other domesticated animals became indispensable « biomechanical » energy sources for agriculture and transportation.

Simultaneously, humans learned to harness the energy of natural elements, such as water and wind. The invention of watermills and windmills mechanized processes like grain milling, wood cutting, and textile production, freeing labor for other productive activities.

Fossil Fuels and the Industrial Revolution

The discovery of coal, and later oil, enabled the development of machines capable of generating far greater quantities of energy than humans, animals, or natural elements. This transition to fossil fuels marked the beginning of the Industrial Revolution—a period of rapid growth in production, urbanization, and technological innovation.

During the Industrial Revolution, steam engines and internal combustion engines facilitated mass production, revolutionized transportation, and accelerated scientific progress. Industrialization and globalization are largely consequences of this intensive exploitation of fossil fuels, which remain the primary energy sources in many countries today.

Modern Comfort and Energy Dependence

Energy Serving Modern Life

In contemporary societies, access to energy is fundamental to maintaining a high standard of living. Rapid transportation systems, household appliances, advanced healthcare infrastructures, communication networks, and entertainment technologies all rely on energy.

On average, an individual in developed countries benefits indirectly from the energy equivalent of hundreds of workers through modern energy sources like electricity and fossil fuels. This level of comfort and productivity would have been inconceivable for previous generations.

Increased Dependence on Modern Energy Sources

Today, most vital infrastructures are powered by electricity and fossil fuels. For example, hospitals, transportation systems, refrigeration, data centers, and communication networks depend on energy to function correctly. This dependence highlights the fragility of modern societies in the face of energy shortages or power outages.

Without energy, many essential services would cease to function, endangering the lives of millions. This increased reliance on energy underscores how vital it has become for the survival and proper functioning of modern societies.

Energy as a Vital Resource for Humanity’s Future

Energy and Human Progress

Mastery of energy has allowed humanity to develop and innovate on an unprecedented scale. Now more than ever, the ability to harness new clean energy sources is critical to addressing environmental challenges and supporting a growing global population. Energy is, in this sense, central to all discussions about the future of civilization.

The Challenge of Energy Transition

Modern societies must now tackle the challenge of replacing fossil fuels with renewable energy sources. This transition is especially urgent as global energy demand continues to rise. Research and development in renewable energy will be crucial for ensuring a stable and sustainable future.

Conclusion: Energy, the Key to Survival and Progress

The history of human civilization is inseparable from the quest for and mastery of new energy sources. Each energy revolution has enabled human societies to grow, organize, and progress. However, this dependence on energy also makes our societies vulnerable to potential crises or shortages. Energy is not only the engine of progress but also a fundamental resource upon which civilization’s survival depends. The ability to master, innovate, and diversify energy sources remains a central challenge for humanity’s future.

The Link Between Energy and Money in History

In this section, we explore how, for centuries, civilizations have used physical objects requiring energy investments to serve as currency. This concept, known as « proof of work, » relies on the idea that a currency’s value is determined by the amount of work or energy required to produce it.

Primitive Currencies and the Concept of "Proof of Work"

Using Physical Objects as Money

Before the advent of fiat currencies (based on trust in a government or institution), many civilizations used tangible objects as money. These objects shared a common trait: they were difficult to obtain or manufacture, ensuring their scarcity and value.

The Stones of Micronesia

On the island of Yap in Micronesia, large limestone disks known as Rai stones served as currency. These stones, sometimes several meters in diameter, were difficult to extract and transport, as they had to be brought from other islands. This production challenge made them highly valuable..

Wampum Shells

Used as currency by Native American tribes in North America, wampum shells required labor-intensive processes to collect, drill, and assemble into necklaces or belts. This painstaking effort conferred value to wampum in trade exchanges.

Concept of "Proof of Work"

« Proof of work » refers to the time, effort, and energy invested in creating a good. The Micronesian stones and wampum shells exemplify currencies with intrinsic value derived from production difficulty. This labor-intensive process, hard to replicate fraudulently, creates a sense of security and trust in these objects’ value.

Gold as the World’s Reserve Currency

Over time, gold became the world’s reserve currency due to its natural rarity and the difficulty of its extraction. Extracting a single ounce of gold requires processing tons of rock, a process that demands significant time and energy investment. This « proof of work » ensures that gold is challenging to acquire, and its scarcity preserves its value over time.

Symbolism of Gold

Gold became a symbol of wealth and stability. Unlike fiat currencies, gold does not rely on trust in a government or authority. Its intrinsic value lies in its acquisition cost. This characteristic made it a cornerstone of traditional monetary systems, used by governments to back currencies and conduct international exchanges.

Role in International Trade

In exchanges between governments and central banks, gold has played a crucial role as a reserve asset. Its value is universally recognized, independent of political or economic systems. Until the 20th century, many monetary systems were gold-based.

Rarity and Security: Why Gold and Other "Proof of Work" Currencies Function

Rarity and Unforgeability

What makes these forms of currency particularly valuable is their rarity and « unforgeability. » For example:

- The Micronesian stones were so difficult to obtain that each piece was unique and bore the marks of the effort required to produce it.

- Gold is rare and challenging to extract, making it a reliable currency that is difficult to counterfeit or reproduce.

Trust and Security in Currency

The value of currencies based on proof of work depends on the trust that no one can create them easily or arbitrarily. This trust is reinforced by the difficulty, if not impossibility, of producing « fake currency. »

From Traditional "Proof of Work" to the Bitcoin Model

Parallel with Bitcoin

Like the Micronesian stones, gold, or wampum shells, Bitcoin is based on the concept of proof of work to establish its value. In the Bitcoin mining system, miners must solve complex mathematical problems, a process that consumes significant energy and requires expensive hardware. This intense and energy-demanding labor forms the basis of each mined Bitcoin’s value.

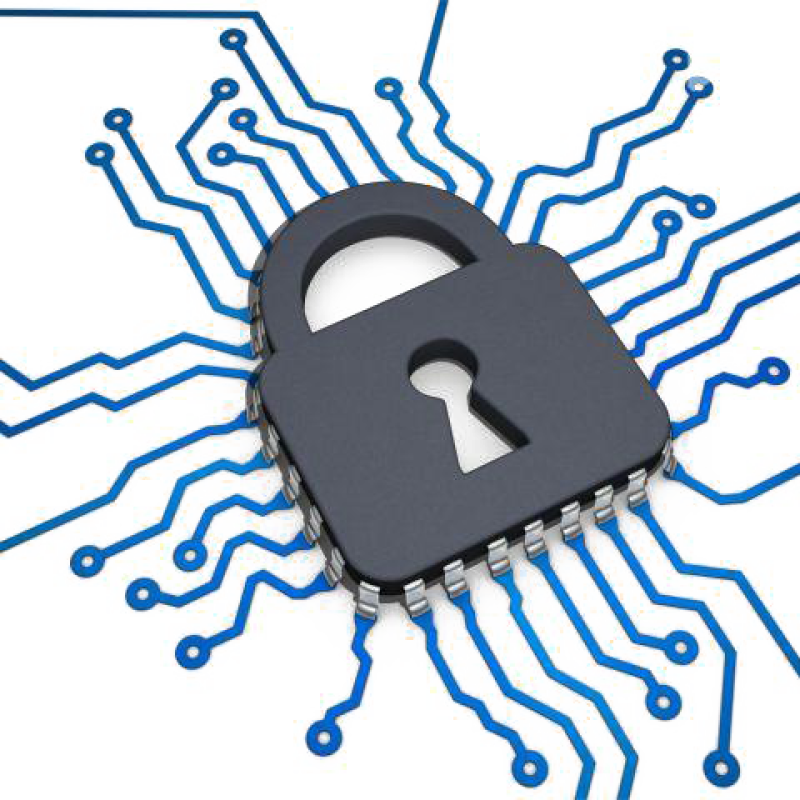

Bitcoin Mining and Network Security

Proof of work ensures the security and integrity of the Bitcoin network. Falsifying the Bitcoin network is practically impossible due to the high energy and computational costs required.

Conclusion: Proof of Work, a Timeless Model of Monetary Value

The concept of « proof of work » has been a constant in the history of money. From ancient civilizations to modern monetary systems, scarcity and production difficulty have always been the cornerstones of assigning value to currency.

By using proof of work in its mining process, Bitcoin follows this tradition and offers a decentralized monetary model where energy and labor play a fundamental role in creating value, without reliance on a central authority.

Thus, Bitcoin, while being a modern digital currency, reinvents an ancient practice, adapting it to the context of today’s global exchanges, where trust and security are paramount.

The Petrodollar and Geopolitical Influence

The global economy has been shaped by the « petrodollar, » a monetary system in which oil is predominantly traded in U.S. dollars. This agreement between the United States and oil-producing countries, such as Saudi Arabia, elevated the dollar to a dominant position in global trade. This monetary dominance not only solidified the U.S. as an economic and military superpower but also had significant geopolitical and environmental implications.

The Birth of the Petrodollar: Context and Origins

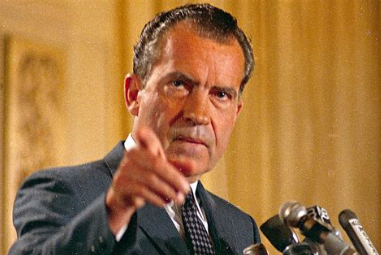

The End of the Gold Standard

In 1971, U.S. President Richard Nixon ended the direct convertibility of the dollar into gold, effectively terminating the gold standard. This decision created a situation where the dollar, now a « fiat currency » (from the Latin fiducia, meaning « trust »), was no longer backed by a tangible asset but depended on trust in the U.S. government and its economy.

Agreement with Saudi Arabia

To sustain global demand for the dollar and prevent massive devaluation, the United States forged a strategic agreement with Saudi Arabia in the 1970s, then the world’s leading oil exporter. Under this agreement, Saudi Arabia committed to selling its oil exclusively in U.S. dollars. In exchange, the U.S. pledged military protection for the Saudi monarchy and agreed to supply it with advanced weaponry.

Global Impact of the Agreement

Following Saudi Arabia’s lead, other members of the Organization of Petroleum Exporting Countries (OPEC) also adopted the dollar as the currency for oil transactions. Thus, the concept of the « petrodollar » emerged, wherein all global oil transactions were denominated in U.S. dollars. This arrangement guaranteed consistent global demand for the dollar, anchoring it as the foundation of international trade.

Geopolitical Consequences and the Consolidation of U.S. Power

American Hegemony in the Global Economy

The petrodollar reinforced the United States’ economic dominance, as countries needed to maintain dollar reserves to purchase oil. This established the dollar as the world’s reserve currency, granting the U.S. significant influence over the global economy and the ability to impose economic sanctions by controlling access to the dollar.

Strengthening U.S. Military Power

In exchange for the oil trade agreement, the U.S. committed to protecting Saudi Arabia and its oil infrastructure. This protection extended to other Gulf countries, consolidating American military presence in the region. The deployment of military resources—including bases, naval fleets, and advanced defense systems—to secure oil supplies became a cornerstone of U.S. foreign policy.

Military Interventions in the Region

Over the decades, protecting American oil interests in the Middle East led to multiple direct and indirect military interventions, such as the Iraq wars and ongoing tensions with Iran. The need to secure oil access and ensure the stability of allied regimes frequently drove U.S. involvement in the internal affairs of these countries.

Environmental and Energy Costs of the Petrodollar

Energy Consumption of U.S. Armed Forces

To maintain oil security and the petrodollar system, the U.S. military consumes enormous energy resources. It is one of the world’s largest oil consumers, burning approximately 4.8 billion gallons of fuel annually. This massive oil consumption, aimed at sustaining the petrodollar hegemony, is rarely addressed in public energy debates, despite its significant environmental impact.

Ecological Footprint of Military Interventions

Military interventions to safeguard oil interests substantially contribute to greenhouse gas emissions. Fighter jets, aircraft carriers, and other military equipment used to secure oil supplies consume vast amounts of fuel, exacerbating the carbon footprint of this energy policy. Additionally, ecological damage caused by wars in oil-producing regions, along with the impact on local ecosystems, is a direct consequence of this dependency.

Implications for Renewable Energy Development

Obstacles to Energy Transition

The petrodollar system creates a mutual dependency between the U.S. dollar and oil. By ensuring consistent global demand for the dollar through oil trade, this system incentivizes the U.S. to maintain its influence over the oil industry and strategic relations with oil producers. This reliance slows the adoption of renewable energy, as the petrodollar’s sustainability is tied to the oil industry’s persistence.

Lack of Investments in Alternative Energy

Because of their dependence on oil and the role of the petrodollar, the U.S. and other economic powers may hesitate to fully invest in renewable energy infrastructure, fearing it could destabilize the oil market and reduce global demand for the dollar. Massive subsidies for the oil industry, including funding for fossil fuel exploration, further delay the transition to clean energy.

Paradox of Bitcoin Energy Criticism

While Bitcoin often faces criticism for its energy consumption, the petrodollar system, which relies on a far larger and more polluting energy base, is rarely questioned in energy debates. Highlighting this paradox invites a reevaluation of priorities and a deeper examination of the environmental and geopolitical costs of the petrodollar.

Evolution and Decline: A Fragile Model?

Growing Geopolitical Challenges

With the rise of other economic powers such as China and increasing criticism of the environmental footprint of the oil industry, the petrodollar model may face growing challenges. Countries like Russia and Iran are actively seeking to bypass the dollar in oil trade, exploring alternative currencies, which could undermine the petrodollar in the future.

Bitcoin as an Emerging Alternative

Some economists and analysts view Bitcoin as a potential alternative to the petrodollar system. It could serve as a decentralized reserve currency, independent of any single nation’s influence. Despite criticism of its energy consumption, Bitcoin’s transparency and lack of reliance on military protection or governmental support distinguish it from the petrodollar.

Conclusion: The Petrodollar, a Fragile Pillar of the Global Economy

The petrodollar has allowed the United States to dominate the global economy and sustain worldwide demand for the dollar for decades. However, this system is resource-intensive and comes with heavy geopolitical and environmental costs.

As the world transitions toward renewable energy, the reliance on the petrodollar may slow this progress. The emergence of new alternatives, such as Bitcoin, could eventually challenge the dollar’s hegemony by offering a more sustainable and decentralized monetary model.

Bitcoin and Energy

Let’s now examine how Bitcoin, as a decentralized cryptocurrency based on the « Proof of Work » (PoW) model, redefines traditional concepts of money and energy. This unique relationship between Bitcoin and energy is essential to understanding its role in energy debates and its potential to promote renewable energy adoption.

Bitcoin as an Energy Currency

The Concept of "Proof of Work"

Unlike fiat currencies, Bitcoin operates on the principle of Proof of Work, a validation system based on intensive computational calculations. This model requires miners to solve complex equations to validate transactions and secure the network, a process that demands significant energy consumption.

Energy and Value Creation

In this system, the energy expended to « mine » bitcoins plays a central role in their value. Each newly created Bitcoin represents not only a digital asset but also an energy equivalent, symbolizing the energetic effort invested in its creation. This gives Bitcoin intrinsic value linked to its production cost.

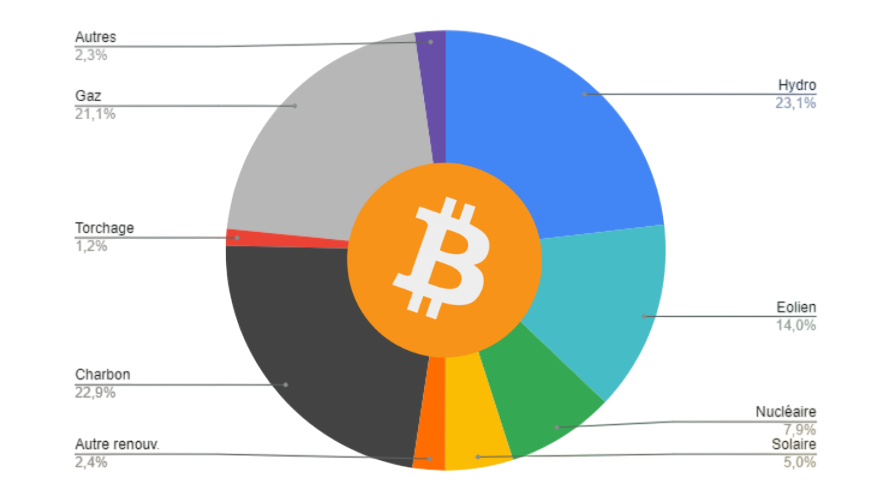

Criticism and Energy Transparency

Bitcoin’s Proof of Work model is unique in its transparent relationship with energy. Unlike other industries, Bitcoin openly displays its energy consumption, which has fueled criticism. However, this transparency is not inherently negative and must be contextualized against other energy uses.

Bitcoin’s Energy Consumption: A Disproportionate Debate?

Bitcoin’s Energy Use

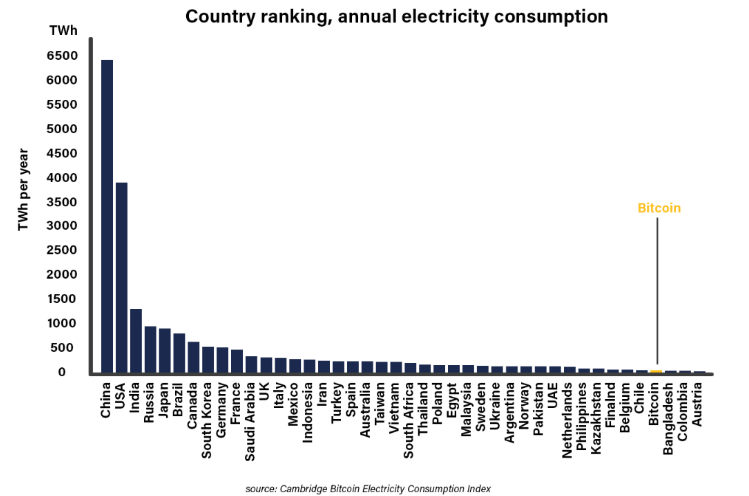

The Bitcoin network currently consumes between 100 and 150 terawatt-hours (TWh) of electricity annually. Although this accounts for approximately 0.1% of global energy consumption, it has sparked significant media debate. While this figure may seem high, it is negligible compared to other sectors in terms of its global energy share.

Comparison with Other Sectors

- Online Advertising: The online advertising industry consumes more energy than Bitcoin, largely for content like spam or irrelevant ads.

- Christmas Lights in the U.S.: Christmas decorations in the United States consume more energy than the entire Bitcoin network, yet this usage rarely faces similar criticism.

- Standby Electronics: In the U.S., « always-on » standby devices consume nearly 1,375 TWh annually, over 12 times Bitcoin’s energy consumption.

These examples show that Bitcoin draws disproportionate scrutiny despite its modest share of global energy use, primarily due to its transparency, novelty, and misunderstanding of its energy model.

Societal Value and Energy Justification

Bitcoin’s energy use should be evaluated in terms of the value it provides. Beyond being a cryptocurrency, Bitcoin represents an alternative, autonomous, and decentralized financial system. It offers solutions to people in unstable economies or under authoritarian regimes, making it a vital tool for millions worldwide. This societal value is one of the primary arguments in favor of its energy consumption.

Why Does Bitcoin Consume Energy?

Network Security

Bitcoin’s energy consumption is essential for securing the network and ensuring transaction integrity. Proof of Work forces miners to perform difficult calculations requiring high computational power and energy. This effort makes the Bitcoin network resistant to attacks, as attempting fraud would require an astronomical amount of energy, rendering it infeasible.

Decentralized Model Without Central Authority

Bitcoin operates in a fully decentralized manner. This means that security and system integrity are maintained by a global network of independent miners, all adhering to the same protocol and using energy to prove their « work. » This model eliminates the need for intermediaries and centralized authorities, offering an alternative to traditional monetary systems.

Bitcoin Mining: A Driver for Energy Innovation

Miners as Cheap Energy Seekers

Bitcoin miners are economically motivated to find low-cost energy. To maximize profits, they often locate in regions with abundant and inexpensive energy, such as hydroelectric, wind, or solar power, depending on local availability.

Utilizing Underused Energy

In many regions, a portion of generated energy is wasted due to low demand or lack of transport infrastructure. Bitcoin mining enables the use of these underutilized or surplus energy resources by setting up mining farms near the source. This approach valorizes otherwise lost energy and promotes resource optimization.

Renewables and Innovation

Bitcoin’s pursuit of affordable energy often leads miners to adopt renewable energy sources, positioning Bitcoin as a potential catalyst for energy innovation. Numerous projects explore using innovative energy sources to power mining operations, paving the way for increasingly efficient and cost-effective energy systems.

Conclusion: Bitcoin, a Catalyst for Green Energy?

By its decentralized design and reliance on Proof of Work, Bitcoin requires significant energy consumption, attracting criticism and sparking debates. However, this same consumption drives miners to adopt clean and affordable energy sources, making Bitcoin a potential driver of innovation in renewable energy and energy waste reduction.

Bitcoin’s influence could become a powerful force in accelerating the global energy transition, proving that its energy usage serves a purpose beyond monetary speculation.

Bitcoin and Energy Sustainability

Let’s delve deeper into how Bitcoin encourages its users to seek renewable energy sources and how it could unexpectedly contribute to promoting sustainable energy practices. The connection between Bitcoin and sustainability rests on two main factors: the search for low-cost energy sources and the utilization of underused energy.

The Search for Renewable and Clean Energy Sources

Competitiveness and Cost Reduction

Bitcoin miners are constantly on the lookout for affordable energy sources to maintain the profitability of their operations. In this context, renewable energy becomes attractive as it is often less expensive in the long term compared to fossil fuels.

Renewables Leading the Way

In many regions, renewable energy sources have become the cheapest options due to technological advancements and local or international subsidies. This reality drives miners to set up operations in areas where these energy sources are abundant and low-cost.

Impact on Local Energy Infrastructure

The presence of Bitcoin mining operations can encourage investment in green energy infrastructure. In some regions, the increasing energy demand from Bitcoin miners can justify the construction of new renewable energy facilities. These investments also benefit local communities by providing access to sustainable energy sources.

The Case Study of El Salvador: Harnessing Volcanic Energy

A Pioneering Initiative

El Salvador has become a trailblazer in adopting Bitcoin as legal tender and using it to promote clean energy. The Salvadoran government has invested in mining infrastructure powered by geothermal energy from volcanoes. This energy source is abundant, reliable, and clean, offering an innovative way for the country to mine Bitcoin while reducing its environmental footprint.

Economic Benefits for Local Communities

This strategy leverages a local natural resource that is typically underutilized, creating jobs and economic opportunities around geothermal power plants. Communities near these volcanoes gain access to electricity, potentially transforming local infrastructure and fostering sustainable development.

A Model for Other Countries

El Salvador’s example demonstrates how regions with untapped or underutilized energy resources can integrate Bitcoin mining to generate revenue and invest in renewable energy. This model could inspire other nations with significant renewable energy reserves to adopt similar approaches

Bitcoin as a Solution for “Lost” or “Stranded” Energy

Excess and Wasted Energy

A significant portion of the world’s energy production is wasted, particularly during periods of low demand or in remote areas far from major consumption centers. Bitcoin miners, as flexible energy consumers, can establish mining farms near these “lost” or “stranded” energy sources to exploit them efficiently.

Capturing Flared Natural Gas

In regions like Texas or Alberta, oil companies often burn off natural gas during oil production, a process known as “flaring.” Bitcoin miners set up portable equipment in these areas to capture and use this gas to power their mining operations. This practice not only reduces greenhouse gas emissions but also converts wasted energy into monetary value.

Deploying Mobile Infrastructure

With mobile mining setups, Bitcoin miners can transport their operations to remote areas with renewable energy sources that are not connected to power grids. For instance, mining platforms can be installed near isolated hydroelectric plants to utilize energy that would otherwise go unused.

Encouraging Renewable Energy Development

Strengthening Green Infrastructure

By consuming surplus or otherwise unutilized energy, Bitcoin mining supports the development of renewable energy. By guaranteeing a stable demand, it provides financial stability to renewable energy projects, which might otherwise be costly and risky without a reliable buyer.

An Economic Incentive Model

Unlike conventional climate policies, Bitcoin creates a direct incentive to seek cheap and clean energy. This consistent demand from miners facilitates investment in innovative energy technologies and drives the growth of renewable energy, particularly in developing regions.

Conclusion: Bitcoin as a Solution for Energy Transition

In summary, Bitcoin mining is more than just a technology that consumes energy. It bridges the gap between the financial sector and renewable energy by utilizing resources that are often wasted or difficult to access. This connection could play a crucial role in the energy transition by creating a stable and profitable demand for large-scale renewable energy sources. Bitcoin may serve as an unexpected catalyst for a greener and more sustainable energy future.

Comparison with Other Monetary Systems

Bitcoin, as a decentralized digital currency, fundamentally differs from traditional fiat currencies, which rely on central banks and government authorities. Bitcoin offers a unique monetary alternative with features such as energy transparency and intrinsic security, making it particularly suitable for contexts of economic volatility and loss of trust in traditional financial systems.

Bitcoin’s Energy Transparency

Bitcoin and Explicit Energy Consumption

Bitcoin is unique in openly displaying its energy consumption. This transparency allows every user to understand the amount of energy required to produce and secure each Bitcoin. In contrast, traditional fiat currencies often have opaque production and maintenance processes.

Comparison with Fiat Systems

Fiat currencies are issued and regulated by central banks, which hold the power to create money out of thin air (“printing money”). This monetary creation leads to the gradual devaluation of currency over time. By comparison, Bitcoin’s production, capped at 21 million units, relies on an energy-intensive but transparent mining process that avoids arbitrary inflation and ensures monetary scarcity

Security and Monetary Autonomy of Bitcoin

No Intermediaries

Bitcoin enables peer-to-peer transactions directly between users, eliminating the need for trust in institutions. This decentralization ensures that the Bitcoin network operates autonomously through its decentralized protocol.

Security Through Proof of Work

Bitcoin’s security is tied to its Proof of Work model, which makes fraud or attacks extremely difficult. To tamper with the network, an attacker would need to mobilize an enormous amount of energy and computing power, making such efforts economically impractical. This energy-based security makes Bitcoin highly resistant to manipulation and external interference, contrasting with centralized banking systems that are more vulnerable to cyberattacks and financial crises.

Bitcoin as an Alternative for Unstable Economies

Hedge Against Inflation in Fragile Economies

In countries experiencing high inflation or economic crises, local currencies can lose value drastically. Bitcoin provides an alternative for citizens in these regions, allowing them to preserve their wealth without relying on unstable local currencies.

Access to Financial Systems for the Unbanked

A significant portion of the global population lacks access to traditional banking services due to the absence of financial infrastructure or administrative and economic barriers. Bitcoin offers these unbanked populations a means to participate in the global economy through a mobile phone and internet connection, without requiring bank accounts or credit cards.

Resilience to Sanctions and Authoritarian Regimes

Bitcoin as a Tool for Economic Freedom

In authoritarian regimes, governments often tightly control money flows and impose severe restrictions on capital movement, making it challenging to access foreign currencies or preserve wealth. Bitcoin provides citizens in these countries with a way to bypass financial restrictions and safeguard their savings.

Bitcoin’s Role in International Sanctions

Governments imposing international sanctions, such as the U.S. through the dollar, can isolate entire nations from the global economy. Bitcoin becomes a valuable alternative for those seeking to circumvent financial blockades.

Inflation-Resistant Currency and Value Preservation

Bitcoin as a Digital Store of Value

With a supply limit of 21 million bitcoins, Bitcoin is often compared to digital gold. While central banks can increase the money supply at will, leading to inflation, Bitcoin’s fixed supply ensures its value is not arbitrarily diluted. This quality makes Bitcoin an attractive option for preserving capital over the long term without the fear of purchasing power erosion due to inflation.

Contrast with Inflationary Currencies

In fiat currency systems, governments and central banks adjust the money supply to address economic needs, which can be beneficial in crises but often results in structural inflation.

Conclusion: Bitcoin, a Unique Monetary System

Bitcoin represents a radically different alternative to traditional fiat currencies, offering energy transparency, enhanced security, and independence from central authorities. It provides an autonomous monetary system that enables individuals—especially in economically unstable contexts or under repressive regimes—to preserve their wealth and bypass financial restrictions. Bitcoin’s resistance to inflation and ability to offer secure, intermediary-free transactions make it a unique option for savers and a valuable alternative to traditional financial systems.

Trust and Inflation Challenges

This section explores how traditional monetary systems are increasingly facing crises of trust and rampant inflation, prompting many individuals and investors to turn to alternatives like Bitcoin. It highlights the fragility of fiat currencies under inflationary policies and monetary creation while explaining how Bitcoin stands out as a potentially resilient store of value against these challenges.

Loss of Trust in Fiat Currencies

Fiat Currencies and Monetary Creation

Fiat currencies, such as the dollar or euro, are controlled by central banks, which can create money to address economic needs. However, excessive monetary creation leads to inflation, eroding currency value and diminishing citizens’ purchasing power. Policies like quantitative easing, aimed at stimulating economies, exemplify mass money printing that can contribute to inflationary pressures.

Chronic Inflation and Hyperinflation

In countries such as Venezuela, Zimbabwe, and Argentina, severe economic crises have resulted in hyperinflation, where the prices of goods and services rise exponentially. These nations often suffer from unstable monetary policies, where money printing to fund public spending leads to rapid devaluation of local currencies.

In hyperinflationary contexts, citizens seek to preserve their purchasing power by turning to foreign currencies (like the U.S. dollar) or safe-haven assets like gold. Bitcoin has gained popularity among these populations because it is easily accessible with an internet connection, provides protection against runaway inflation, and is decentralized, avoiding government control.

Inflation’s Impact on Trust

When citizens witness their purchasing power eroded by inflation, confidence in their currency declines. This erosion of trust is exacerbated in some countries by poor economic management and political instability, driving people to safeguard their wealth through more stable currencies, gold, or increasingly, digital assets like Bitcoin.

Security and Decentralization as Pillars of Trust

No Central Authority and Protection Against Manipulation

Bitcoin’s decentralized nature is one of its key strengths. Its lack of a central authority bolsters trust, as Bitcoin cannot be subjected to political or economic manipulation

Transparency of the Bitcoin Network

The Bitcoin network provides total transparency: all transactions are publicly accessible on the blockchain, allowing anyone to verify money flows without relying on an institution. This transparency is a major advantage in a climate of growing distrust toward banks and financial institutions, which may obscure or manipulate data.

Bitcoin in the Face of Global Economic Fluctuations

Resilience to Global Financial Crises

Bitcoin is not directly influenced by the economic policies of governments or central banks. This independence means that Bitcoin can act as an uncorrelated asset, offering diversification opportunities for investors during economic turmoil. Many investors view Bitcoin as a potential hedge against global financial crises.

Bitcoin’s Volatility: A Risk and an Opportunity

While Bitcoin is often seen as a hedge against inflation, it remains a volatile asset. For some, this volatility is a risk, but for others, it presents an investment opportunity, as price swings create potential for significant gains.

Conclusion: Bitcoin, a Potential Refuge Against Inflation and Loss of Trust

Bitcoin is emerging as an alternative for those seeking protection from inflation or losing confidence in fiat currencies. Its growing popularity underscores the demand for a monetary system independent of governments and traditional financial institutions. By providing decentralization, transparency, and protection against inflationary policies, Bitcoin offers a compelling solution to the challenges faced by conventional monetary systems.

Conclusion, a synergy with many assets for the future

Bitcoin, far more than just a cryptocurrency, stands out for its unique characteristics and potential to offer sustainable solutions to modern economic challenges. Based on a proof-of-work model that requires measurable energy effort, Bitcoin emerges as a rare and secure currency, akin to gold but tailored to the digital age. This security model, maintained by the network itself, allows Bitcoin to resist monetary manipulation and arbitrary inflation.

Unlike fiat currencies, Bitcoin provides a stable store of value due to its capped supply. This feature attracts not only investors seeking protection from monetary devaluation but also citizens in countries suffering from chronic monetary crises. In such contexts, Bitcoin serves as a capital preservation tool, independent of local economic decisions.

Its decentralized and transparent nature also makes it a viable solution for populations living under authoritarian regimes, where money flows are tightly monitored and restricted. This system frees users from reliance on local authorities, granting them access to a secure financial space resistant to censorship. Furthermore, in a global context of economic sanctions and restrictions, Bitcoin remains the only means for some populations to bypass these barriers and access international financial resources.

Another key aspect of Bitcoin’s potential impact lies in its role in the energy transition. Although often criticized for its energy consumption, Bitcoin could be a significant lever for the adoption of renewable energy. El Salvador’s example illustrates this potential: in regions rich in natural resources, Bitcoin can serve as a catalyst for the development of sustainable infrastructure.

Thus, Bitcoin is much more than a digital currency. It is a resilient financial tool against inflationary monetary policies, a refuge for populations under unstable regimes, and a source of innovation for renewable energy.

In a world searching for new and sustainable solutions, Bitcoin represents a model of transparency, security, and financial autonomy that could redefine our approach to money. It positions itself not only as an alternative to traditional banking systems but also as a driver of change for a more sustainable and inclusive future.